How to find person details from pan number

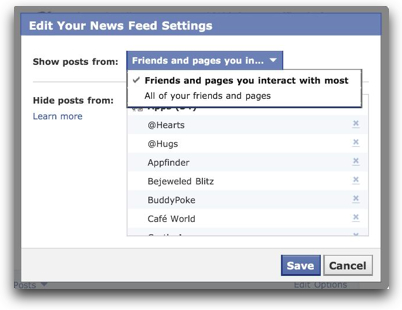

Some times we found difficulties while registering with e-filling website. What to do? How to know the name of the person, which matches exactly with Income Tax Records? Here we would discuss one methods by which we can know the name of person exactly the same as in Income Tax records if we have his PAN.

SEE VIDEO BY TOPIC: How to Check your PAN CARD Details online - How to know PAN Card AddressContent:

- How can I see my PAN Card details? Easy steps to check, verify PAN Card on Income Tax website

- MCA Services

- Know your Permanent Account Number (PAN)

- Verify Your PAN

- How banks verify your PAN card details

- KNOW YOUR PAN CARD DETAILS / DATA

- Get PAN Card Details

- Know Your PAN Card

- GST Number Search by Name and PAN

How can I see my PAN Card details? Easy steps to check, verify PAN Card on Income Tax website

But I didn't received the card. So I approached NSDlcenter and applied for anew card. I got it in 8 days. After few days I received another card which I had applied earlier. How to I return one card? There are two different thing here. You have two PAN Cards. Please check if both the card have exact same PAN Number.

If the number is same, you are good. You don't have to do anything. You can keep both the cards. It's illegal for a person or company to have more than one PAN Number. If caught, Income Tax Department can take a legal action or put financial penalties. List of all questions Ask your question. Best Discount Broker in India. Best Full-Service Brokers in India. Unlimited Monthly Trading Plans. Compare Share Broker in India.

I have got two PAN Cards. How do return or close the duplicate PAN Card? As this happed accidently with you, here are ways to surrender the duplicate PAN Number: Manually Submitting the Application Write a letter to this effect to the assessing officer under whose jurisdiction you have been filing your returns. The letter must contain details such as your name, contact details, details of the PAN Card to be retained, details of the duplicate PAN Card s which you need to surrender, etc.

Keep the acknowledgement copy of the letter that you have filed with the I-T department, stating that you are surrendering your additional PAN. That is sufficient as proof of surrender and no additional confirmation from the I-T authorities is required. On receipt of the acknowledgement, there is no need for you to wait for intimation from the income tax department considering that the PAN submitted has now been cancelled by them.

The acknowledgment copy of the letter submitted will more than solve the purpose. See point no. Tick the box in front of point No When I try to apply for the pan card first time, it shows a pan card with same name, address is existing already. What should I do now? Whom to contact to make a complaint about this forgery? Dear medam my pan card 2 different number received.

I have 1 old pan card but today by mistakly I applied new pan card so now how can I cancel my new pan card..?

Hello Dr. Girish, For sole proprietor business there is no separate PAN. Your PAN should do. In my opinion they should not have any problem. You can hire a local CA to explain them the matter. I have two PAN cards in 2 different names.

I got one first in my "Old Name" then got one more with the "Changed Name". I want to surrender the one with Old name. Load more comments 1 replies. I have two pan card and want cancel the earlier one. Can it be done through online method? Sir mere pass 2 pan card h wo bhi alag alag name se and dob bhi alag h.

Good morning I had two pan card when I applied for personal loan they said u had two pan no long back when I applied for pan I had received new pan card but it creating problems for me how to close the one kindly guide.

Sir, I got 2 Pan cards Because of some technical issues.. So I want to surrender One of that Anybody kindly give the text back I'm new to Banglore Load more comments 3 replies. Good morning I had two pan card when I applied for personal loan they said u had two pan no long back when I applied for pan I had received new pan card but it creating problems for me how to close the first one kindly guide. Please help me out. I stay at Surat and 1 pan card is from bokaro and other is from Ahemdabad Load more comments 2 replies.

I have received second pancard for technical reason. What I have to do. Sir, I am given up-date the my date of birth in pan card, but I received the one more different number pan card, old one i am using my Bank account and EPF. I have applied home loan than bank have tell me you ha ve two pan card but i have only one card other card have not any transaction but both card have different address so plz tell me how delink the second card for my account.

Good morning I had two pan card when I applied for home loan they said u had two pan no long back when I applied for pan I had received new pan card but it creating problems for me how to close the first one kindly guide. Dear Arti, If applied through NSDL e-Gov, please provide the 15 digit acknowledgement number to enable us to provide further information.

Sir I have two oan card. Kindly tell me the solution. Mere pas 2pan card hai Mike ek surrender karna hai to bypost process Batavia. I got pan card but name is mistaken and I applied for bank account.

Next I send the card for name correction and I got it but pan number is different. Now what to do? How to returne another persone pan card..

How to get the details of pan card. I had applied for pan card through a private centre in the month of may but did not get upto the month of August and i enquired that private centre , they said my filled form had some mistakes so they asked my certificate and passport photo copy and i had given to them. Though i had given my proof, I didn''t get any kind of information so had applied a new pan card from the another centre and i got it with in 3 weeks and by using that pan number i had open my bank account.

But now got the another pancard which was applied first. Now i have two , so please me correct details to return my pan card. Post New Message. Can minor apply for pan card? I have a PAN Card. Is it compulsory for me to file taxes? How long does it take to get PAN Card? What all documents require for applying PAN Card? How many demat accounts one person can open with one PAN card?

If not what are the alternate requirements? How many pan cards can a person hold? A person is having two demat account with single pan card, can he apply for ipo from both the accounts? Do I have to reapply for a PAN when move or transfer from one city to another?

Is my photo printed on pan card? My friend have no parents or guardian orphan. Can he apply for PAN Card? How to apply PAN Card of a minor? Who should sign in the form; child or parent? Whose photo should affix in form; child or parent? What is the process to change the name and date of birth on PAN Card? How much does it cost? How much does it cost for correction in PAN Card?

Whether photo is affixed in a minors PAN Card? Is it mandatory for a minor to apply for PAN Card for opening a bank account? In how many days we can get pan number? How long does it take to generate new PAN Card since once rejected due to documents issue? In case minor applying for PAN Card, what proofs he has to submit?

MCA Services

Markets have corrected, it's the best time to invest in mutual funds and save 46, in taxes a year. Updated on Mar 30, - AM. In brief, PAN is a unique ten-digit identification number allotted to every person who has applied for it, and it was introduced to track financial transactions taxable in nature. PAN card serves as identity proof and also assists in monitoring tax evasion. Individuals and institutions such as banks, companies and other business entities can verify the PAN details of an individual with the income tax department.

All rights reserved. For reprint rights: Times Syndication Service. Personal Finance News. Godrej Consumer.

Know your Permanent Account Number (PAN)

Account Options Sign in. Top charts. New releases. Add to Wishlist. PAN is a unique identification number assigned to Indians, mostly to those who pay tax. The PAN system of identification is a computer-based system that assigns unique identification number to every Indian tax paying entity. Through this method, all tax related information for a person is recorded against a single PAN number which acts as the primary key for storage of information. This is shared across the country and hence no two people on tax paying entities can have the same PAN. Track the Application Status any time from your smartphone.

Verify Your PAN

Permanent account number, or PAN, is a unique digit alphanumeric identifier given by the Department of Income Tax to any individual in the form of a physical card. For filing income tax return and for any correspondence with the income tax authority, this is mandatory for all the individuals. In PAN Card was made compulsory for all taxpayers within four years of its implementation. The system developed to its present phase in , however, and the compulsory condition was strictly implemented from , beginning first in Delhi, Mumbai, and Chennai.

It is a digit character alphanumeric number allotted to PAN Cardholder served in the form of Government-issued identification. It helps in the identification of income taxpayer or PAN Cardholder. PAN card required in case of your salary is under taxable slab, taxable professional fees, for opening a bank account or for sale or purchase of assets. You can easily get to know about PAN card details via multiple avenues.

How banks verify your PAN card details

If you think that a PAN card could be fake, you can verify its authenticity with the income tax department Banks and other organisations use bulk PAN verification facility to check whether your PAN card details are correct. Some entities might be satisfied by just having the number while others might ask you to submit a photocopy or soft copy of the document. It is unique to each income tax assessee and is a must for filing income tax returns ITR and carrying out several transactions.

But I didn't received the card. So I approached NSDlcenter and applied for anew card. I got it in 8 days. After few days I received another card which I had applied earlier. How to I return one card? There are two different thing here.

KNOW YOUR PAN CARD DETAILS / DATA

The PAN Card number enables the Income Tax Department to link transactions such as tax payments of the cardholder with authority concerned. PAN Card also acts as a photo identity of the individual holding it. Subsequently, a page will ask for the OTP which you will receive on your registered mobile number. Once you receive the OTP, you need to enter it. Like us on Facebook and follow us on Twitter. Financial Express is now on Telegram. Click here to join our channel and stay updated with the latest Biz news and updates. Stock Market.

A permanent account number PAN is a ten-character alphanumeric identifier, issued in the form of a laminated "PAN card", by the Indian Income Tax Department , to any "person" who applies for it or to whom the department allots the number without an application. It is also issued to foreign nationals such as investors subject to a valid visa, and hence a PAN card is not acceptable as proof of Indian citizenship. A PAN is necessary for filing income tax returns.

Get PAN Card Details

.

Know Your PAN Card

.

.

.

GST Number Search by Name and PAN

.

.

-

Vot

VotCompletely I share your opinion. In it something is also idea excellent, I support.

-

Dushakar

DushakarIt is exact